Are you checking for Link Aadhar

Here is the full tutorial for Link Aadhar with Pan Card. Without a Fine linking Aadhaar as per the law, it is impossible now. So you need to pay Rs.1000 as a fine during the process of linking your PAN and Aadhaar. If you reject the linking of PAn with AAdhar may affect your Bank accounts and other financial things which are connected to your PAN card.

$ads={1}

The last date to link your Aadhaar card with a PAN card is March 31, 2023 (Extended to JUNE 30, 2023), as per the Income Tax Department order, PAN numbers not linked with your Aadhaar will be deactivated from April.

How to Check PAN Aadhaar Linking

It should be noted that the income tax department will not process your income tax returns if your PAN and Aadhaar are not connected when you file them. To link the two identity cards in both situations—identical names in the two databases or a case where there is a slight discrepancy—people can go to the official Income Tax e-filing website.

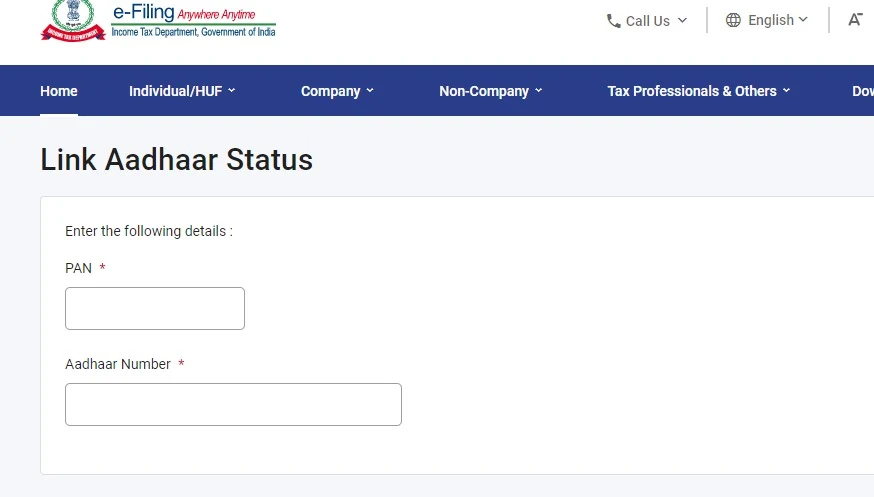

If you are not sure if your PAN and Aadhaar cards are linked, you may follow these steps to confirm:

- Visit the Income Tax Website

- Enter your PAN Number and AADHAAR Number, then click ‘View Link Aadhaar Status’.

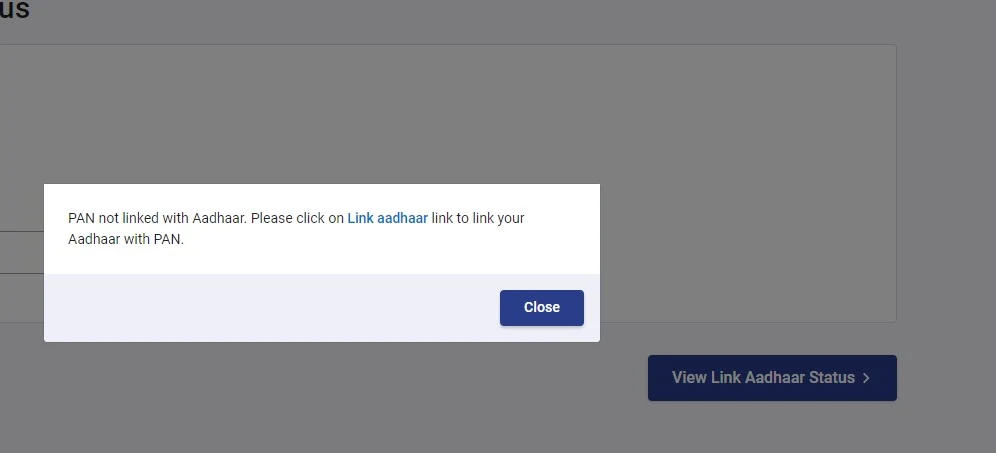

- You will now notice a pop-up as shown below if your PAN and Aadhaar are not linked. To connect them, just adhere to the procedures below. If they are already connected., you can continue with your income tax filing.

How to Link Aadhaar with Pan Card?

Two main steps for linking your Aadhar with your PAN:

- Payment of fee on NSDL portal under Major head (0021) and Minor head (500) for AY 2023-24.

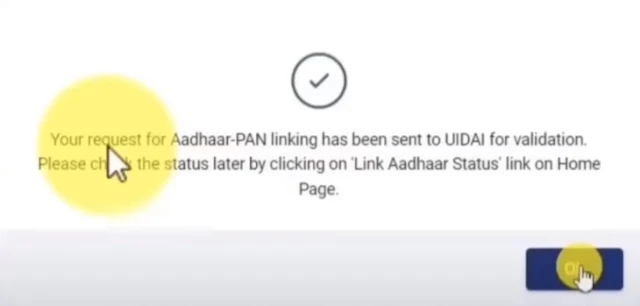

- Submit the Aadhaar-PAN link request.

Documents to keep handy:

- Aadhaar Card

- PAN Card

- Any Mobile Number

Procedure to Link PAN with Aadhaar

|

FAQ

Step:1 Visit e-Filing Portal Home page and click on Link Aadhaar in Quick Links section.

Step:2 Enter your PAN and Aadhaar Number and click Continue.

Step:3 Click on Continue to Pay Through e-Pay Tax.

Step:4 Enter your PAN, Confirm PAN and any Mobile number to receive OTP

Step:5 Post OTP verification, you will be redirected to e-Pay Tax page.

Step:6 Click on Proceed on the Income Tax Tile.

Step:7 Provide Assessment Year as 2023-24 and other mandatory details and click on Proceed.

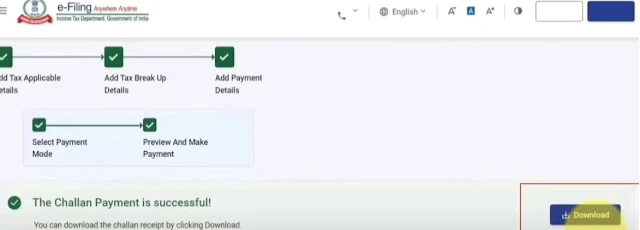

Step:8 Applicable amount will be pre-filled against Others and click Continue.

Last date for Aadhaar PAN Link 2023 will be March 31, 2023.

The payment made at e-Pay tax/ NSDL (now Protean) takes few days to reflect at the e-Filing portal, so taxpayer is advised to attempt raising PAN-Aadhaar linking request after 4-5 days of making payment. Challan details will also get updated in 26AS.

The PAN card of a person will become inoperative when it is not linked to an Aadhaar card. PAN-Aadhaar linking is required when filing the Income Tax Return (ITR). The IT department may reject the ITR when PAN and Aadhaar are not linked.