HRA Form 2025: Your Complete Guide to the House Rent Allowance Application PDF

HRA Application PDF: If you’re a salaried employee in India planning to claim House Rent Allowance (HRA) for the financial year 2024–25 (Assessment Year 2025–26), it’s essential to understand the process and documentation required. The HRA Application Form is a crucial document that helps you avail tax exemptions under Section 10(13A) of the Income Tax Act.

Table of Contents

What is the HRA Application Form?

The HRA Application Form is a declaration submitted by employees to their employers, stating that they are paying rent for residential accommodation and are eligible to receive HRA benefits. This form serves as proof for employers to provide tax exemptions on the HRA component of the salary

Types of HRA Forms

Depending on your employment sector, different formats of the HRA Application Form are used:

1. Government Employees (Central/State)

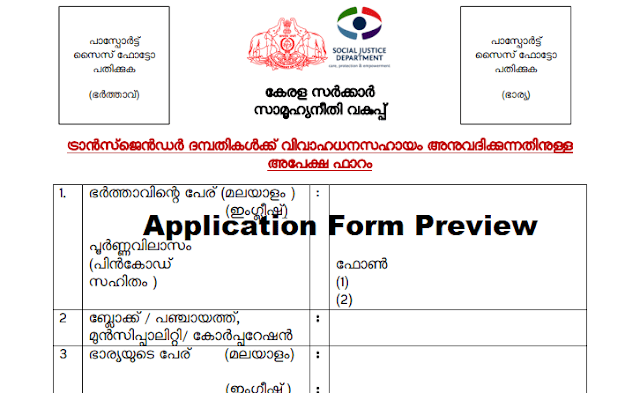

Government employees are required to submit a standardized form, often referred to as Annexure ‘A’. This form includes:

- Employee’s name, designation, and pay details

- Landlord’s name and address

- Details of the rented accommodation

- Monthly rent paid and HRA amount claimed

- Certification by the Head of Officein.

2. Private Sector Employees

Private sector employees typically use a self-declaration form that includes:

- Annual rent paid

- Mode of rent payment (cash, cheque, online)

- Landlord’s PAN (mandatory if annual rent exceeds ₹1 lakh)

- Declaration to continue rent payments through the financial year

Key Details Required in the HRA Form

When filling out the HRA Application Form, ensure you provide the following information:

- Employee Details: Name, designation, employee ID, and department.

- Rental Details: Address of the rented property, duration of stay, and monthly rent paid.

- Landlord Information: Name, address, and PAN (if annual rent exceeds ₹1 lakh).

- Declaration: A statement confirming that you are not residing in government accommodation and are incurring rental expenses.

Submission Deadlines

Employers usually collect HRA declarations and proofs in December for the ongoing financial year. However, it’s advisable to check with your HR department for specific deadlines. Timely submission ensures that the HRA exemption is reflected in your Form 16, simplifying the tax filing process.

Important Points to Remember

- Rent Receipts: If your monthly rent exceeds ₹3,000, it’s recommended to keep rent receipts as proof.

- Landlord’s PAN: Mandatory if the annual rent exceeds ₹1 lakh.

- Mode of Payment: While cash payments are acceptable, online or cheque payments provide a clear audit trail.

- Own House: You cannot claim HRA if you reside in your own house, even if you are paying EMIs.

Download HRA Forms

For your convenience, here are direct links to download the HRA Application Forms:

- Government Employees:

By accurately filling out and submitting the HRA Application Form, you can avail tax exemptions and reduce your taxable income. Ensure all details are correct and supported by necessary documents to avoid any issues during tax assessments.