SBI KYC Form 2025 PDF

Are you looking to update your SBI KYC details in 2025? Download the latest SBI KYC Form 2025 PDF directly from our website and avoid long bank queues. This guide will help you understand everything you need to know about the SBI KYC process, how to fill the form, and submit it without hassle.

Table of Contents

What is SBI KYC Form?

KYC (Know Your Customer) is a mandatory verification process introduced by the Reserve Bank of India to prevent identity fraud and financial crime. SBI requires all its customers to periodically update their KYC details using the official SBI KYC Form.

Who Needs to Submit the SBI KYC Form?

You need to submit the SBI KYC Form if:

- You’re opening a new SBI account (Savings/Current)

- Your account is frozen or inactive

- You’re updating your address, phone number, or identity documents

- SBI sends a notice for periodic KYC update (usually every 2-5 years)

Documents Required for SBI KYC 2025

Here are the accepted KYC documents for individuals:

Proof of Identity (any one):

- PAN Card (mandatory for most)

- Aadhaar Card

- Voter ID

- Passport

- Driving License

Proof of Address (any one):

- Aadhaar Card

- Electricity/Water Bill (last 3 months)

- Passport

- Bank account statement

- Rental agreement

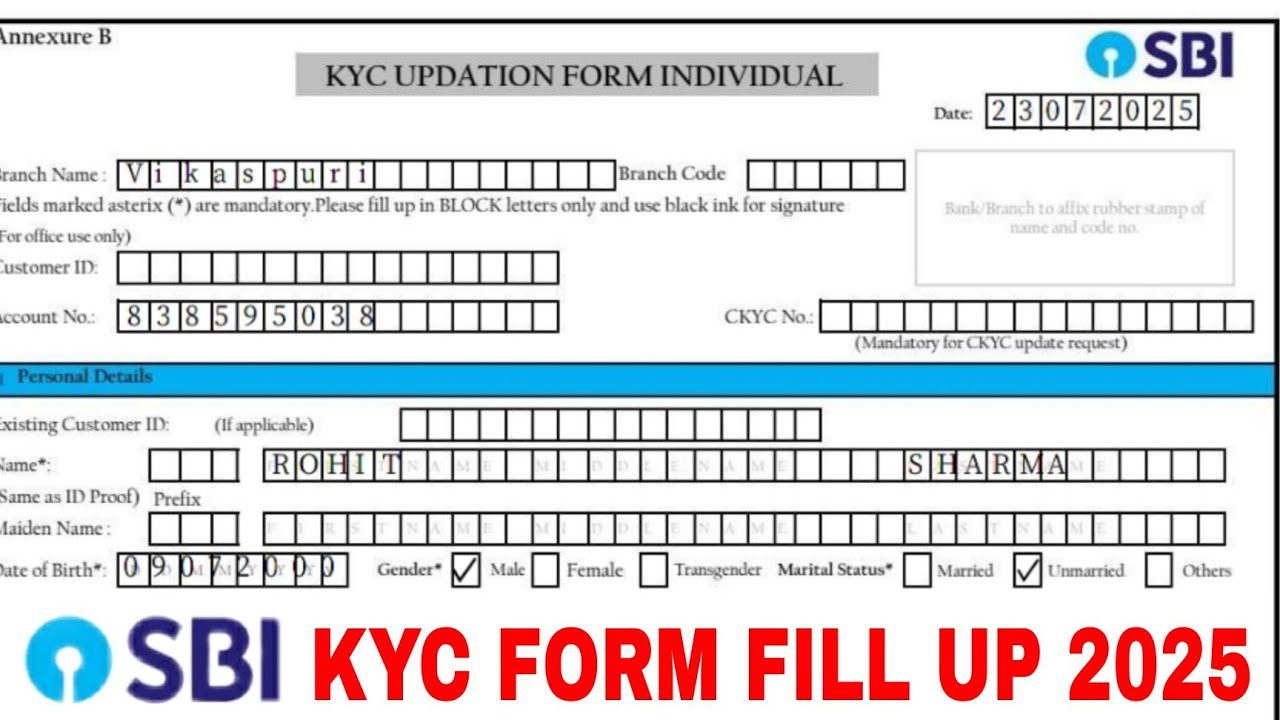

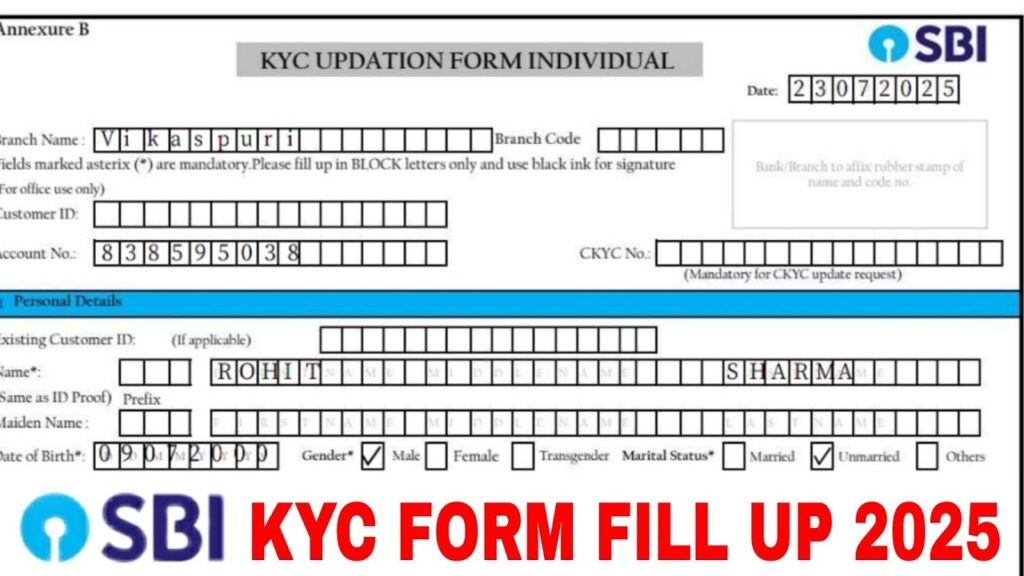

How to Fill SBI KYC Form 2025 PDF?

Filling the KYC form is simple. Follow these steps:

- Download the Form from the above section.

- Enter your name, account number, PAN number, and Aadhaar.

- Tick appropriate boxes under identity and address proof.

- Paste your passport-size photo and sign in the given space.

- Attach self-attested copies of your documents.

- Submit the form to the nearest SBI branch.

Can You Submit KYC Form Online?

Yes, SBI allows customers to update KYC via email for certain updates (like address or re-KYC). You can:

- Fill and scan the signed KYC form

- Attach scanned documents

- Email to your SBI branch’s official email ID

Note: Always confirm with your home branch before sending the KYC via email.

SBI KYC Update Deadline 2025

SBI may notify customers to update their KYC details via SMS or email. If you received a message, update your KYC before the mentioned deadline to avoid your account being frozen.

SBI Internet Banking Reactivate Form 2025 – Step-by-Step Guide & PDF Download

FAQs About SBI KYC Form 2025

Q1. What is the SBI KYC form used for?

The SBI KYC form is used to verify or update a customer’s identity and address proof with the bank as per RBI guidelines.

Q2. Is PAN Card mandatory for SBI KYC?

Yes, PAN is mandatory for most accounts, especially if your transactions exceed ₹50,000.

Q3. Can I submit the KYC form online in 2025?

For minor updates, yes. But for new accounts or major changes, visiting the branch is necessary.

Q4. What happens if I don’t update my KYC?

Your account may be blocked or frozen for transactions until you submit the updated KYC form.

Q5. Can senior citizens submit KYC via post or email?

Yes, SBI allows senior citizens to submit KYC documents by email or post, depending on the branch policy.

Keeping your KYC updated is essential to continue using your SBI bank account without interruptions. You can now easily download the SBI KYC Form 2025 PDF from our website, fill it, and submit it to your nearest branch or online if allowed.