UBI KYC form PDF Download

In today’s digital banking era, keeping your account details up to date is essential for uninterrupted services. For customers of Union Bank of India, one of the country’s leading public sector banks, completing the Know Your Customer (KYC) process is a regulatory requirement that ensures security and compliance. The Union Bank KYC form is a key document in this process, and fortunately, it’s available as a downloadable PDF. In this guide, we’ll walk you through what the Union Bank KYC form is, why it’s important, where to download it for free, and how to use it effectively..

UBI KYC form PDF is available for free download from the article. You can also read the content online using the bottom link.

UBI KYC Form

UBI KYC form PDF can be downloaded for free or read online at the official website linked below this article.

United Bank of India uses the UBI KYC form to verify its customers’ identities and ensure the integrity of financial transactions. KYC is an important regulatory requirement that financial institutions and government agencies impose to combat financial fraud and money laundering.

KYC stands for “Know your Customer”. This is the process that banks use to obtain information on the customer’s identity and address. This helps ensure that the banks’ services aren’t misused.

What Is the Union Bank KYC Form?

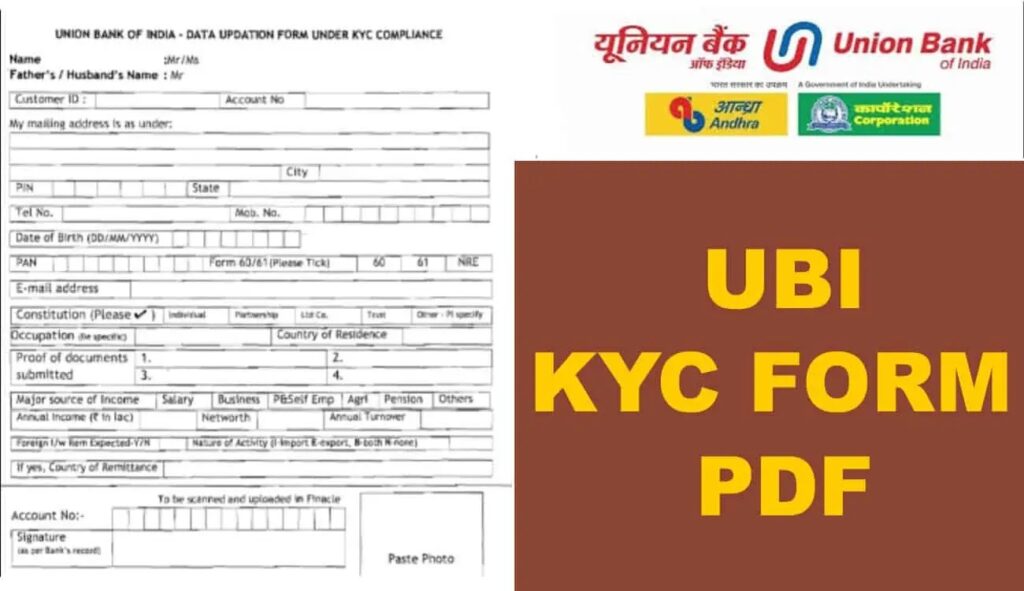

The Union Bank KYC form, officially known as the “Data Updation Form Under KYC Compliance” (Annexure III), is a standardized document used by Union Bank of India to collect and update customer information. KYC, or Know Your Customer, is a mandatory process enforced by the Reserve Bank of India (RBI) to verify the identity, address, and financial details of bank account holders. This helps prevent fraud, money laundering, and other illegal activities while ensuring a safe banking environment.

The form is required when opening a new account (savings, current, or otherwise) or updating existing account details, such as a change of address or contact information. It’s applicable to individuals, joint account holders, proprietors, partners, directors, trustees, and other authorized signatories. By downloading the Union Bank KYC Form PDF, customers can conveniently complete this process at their own pace.

Why Is the KYC Form Important?

The KYC process is more than just a formality—it’s a legal and regulatory necessity. Here’s why downloading and submitting the Union Bank KYC Form PDF matters:

- Regulatory Compliance: The RBI mandates periodic KYC updates to ensure banks maintain accurate customer records. For high-risk customers, this is required every two years; for medium-risk, every eight years; and for low-risk, every ten years.

- Account Security: Verifying your identity protects your account from unauthorized access and fraudulent activities.

- Uninterrupted Services: Failure to update KYC details can lead to restrictions on your account, such as limits on transactions or even account freezing.

- Fraud Prevention: KYC helps banks monitor suspicious activities, safeguarding both customers and the financial system.

For Union Bank customers, downloading the KYC form PDF is the first step toward maintaining compliance and enjoying seamless banking services.

UBI KYC form (Documents Individuals).

- Passport.

- Voter’s identity card

- Driving Licence.

- Aadhaar Letter/Card.

- NREGA Card

- PAN Card

UBI KYC is important to ensure the security and transparency of all your financial transactions with the United Bank of India. This form not only protects you as a client but also helps maintain the integrity of the financial system. Remember that banks will update their KYC records periodically, so you should stay up-to-date and provide any requested updated documentation or information.